This Day in Legal History: Rush-Bagot Treaty

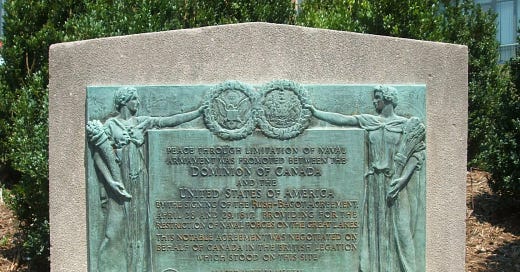

On April 16, 1818, the United States Senate ratified the Rush-Bagot Treaty, a landmark agreement with Great Britain that fundamentally reshaped security along the U.S.-Canada border. Negotiated in the aftermath of the War of 1812, the treaty aimed to de-escalate military tensions between the two nations by significantly limiting naval armaments on the Great Lakes and Lake Champlain. Specifically, it allowed each country to maintain only a single military vessel on Lakes Ontario and Champlain and two vessels on the upper Great Lakes, each restricted in size and armament. The treaty marked a mutual commitment to demilitarization and ushered in a new era of diplomacy.

The negotiations were spearheaded by Acting U.S. Secretary of State Richard Rush and British Minister to the U.S., Charles Bagot. Though initially framed as an exchange of diplomatic notes rather than a formal treaty, it was nonetheless submitted to the Senate for ratification, reflecting its constitutional significance. The Rush-Bagot Treaty laid the groundwork for what would become the world's longest undefended border. It also set a precedent for the peaceful resolution of border disputes through legal and diplomatic means rather than military force.

While tensions between the two nations would persist in other areas, the Great Lakes remained largely free of armed conflict, validating the treaty’s long-term effectiveness. Over time, the agreement became a model of arms control and remains in effect today, albeit with amendments reflecting evolving security concerns. Its ratification on this day helped steer U.S.-British relations toward lasting peace and cooperation, especially in North America. The treaty’s enduring legacy is a testament to the power of legal frameworks in shaping geopolitical stability.

The U.S. Department of Justice filed a lawsuit against the state of Maine, escalating tensions between the Trump administration and the state over transgender athletes' participation in girls' and women’s sports. The suit alleges that Maine is violating Title IX by permitting transgender female athletes to compete on girls' teams, citing recent examples from high school track events. Attorney General Pam Bondi announced the action days after the administration attempted to cut off Maine’s federal school funding and school lunch programs.

This legal move follows a standoff between President Trump and Maine Governor Janet Mills, who rebuffed Trump’s executive order banning transgender athletes from female sports. Mills told Trump, “We’re going to follow the law, sir. We’ll see you in court.” The administration's Title IX-based complaint argues that allowing transgender participation undermines fairness and safety, though no specific safety threats are detailed—of course.

The Department of Education had already announced the suspension of $250 million in K-12 education funding for Maine, while the Department of Agriculture sought to freeze school lunch support. A federal judge has temporarily blocked the USDA’s actions after Maine sued the federal government. Maine’s Assistant Attorney General, Sarah Forster, pushed back, arguing that Title IX does not prohibit schools from including transgender girls in girls’ sports and criticized the federal government's lack of legal precedent.

US to take legal action against Maine over Trump executive order on transgender athletes | Reuters

Senate Majority Leader Chuck Schumer announced he will block President Trump’s nominations of Jay Clayton and Joe Nocella to serve as U.S. attorneys in New York’s Southern and Eastern Districts, respectively. Schumer’s refusal to return the customary “blue slip” signals his opposition and sets up a potential clash over the Senate tradition that gives home-state senators influence over federal prosecutor and judge appointments. He cited concerns that Trump intends to politicize the Justice Department, accusing him of seeking to weaponize law enforcement against political enemies.

Clayton, a former SEC chair, was nominated to oversee the Southern District, which includes Manhattan and is often referred to as the nation's "Wall Street watchdog." Nocella, a state judge, was tapped for the Eastern District, covering Brooklyn, Queens, and Long Island. Schumer's move could provoke Republicans to eliminate the blue slip practice for U.S. attorney nominations, as they previously did for circuit court judges.

While Senate Judiciary Chair Chuck Grassley had earlier indicated he planned to preserve the blue slip process for U.S. attorney picks, growing political tensions may lead to changes. The debate echoes earlier pressure on Democrats to bypass blue slips during the Biden administration for nominees in states with GOP senators. Meanwhile, other Democratic senators, like Adam Schiff, are also using procedural holds to delay nominees they find objectionable, such as Ed Martin, who previously defended January 6 participants.

Schumer to Block Jay Clayton as Top US Prosecutor in Manhattan

President Donald Trump's threat to revoke Harvard University's tax-exempt status has sparked broader concerns about the politicization of the IRS and a potential crackdown on nonprofits. His warning followed Harvard’s refusal to meet administration demands tied to federal funding, prompting a freeze of over $2.2 billion in grants. Other universities like Columbia, Cornell, and Princeton also saw funding halted, amid GOP claims that schools are failing to curb antisemitism after protests over the Israel-Hamas war.

Critics see Trump’s move as an attempt to use federal tax authority to punish political opponents. Legal scholars warn that using the IRS in this way echoes past abuses, such as those during Nixon's presidency. Some nonprofits have already started removing diversity, equity, and inclusion (DEI) language from websites to avoid scrutiny, with lawyers reporting a spike in “DEI audits.” Though the IRS hasn’t yet changed its enforcement patterns, reduced staffing could make it more susceptible to politicized influence.

A recent executive order from Trump targeting “illegal DEI” efforts has heightened fear among nonprofits that their programs, especially those aimed at underrepresented communities, could be labeled discriminatory. Meanwhile, conservative activist Edward Blum has asked the IRS to investigate several foundations for offering race-specific grants, hoping to set a precedent against such practices. Legal experts say programs must be evaluated based on whether they exclude other races, which would likely violate federal law.

Trump’s Harvard Threat Raises Specter of IRS Nonprofit Crackdown

In my column for Bloomberg this week, I argue that proposals to exempt college athletes' name, image, and likeness (NIL) income from state taxes undermine one of tax policy's core principles: horizontal equity. That principle holds that taxpayers with similar incomes should be taxed similarly—something these NIL exemptions blatantly violate. While some student-athletes now earn six or seven figures, their peers working long hours in campus jobs continue to pay tax on modest earnings. Exempting high-income athletes while taxing low-wage student workers creates a two-tiered system that rewards fame and marketability, not need or effort.

These exemptions aren’t rooted in sound tax design—they’re political moves, often motivated by the desire to curry favor with voters who are fans of college sports. But when states exempt wealthy student-athletes, they’re making a value judgment: that celebrity deserves more support than everyday work. Even in states where lower-income students may owe no tax, the policy distinction is stark—exempting income to prevent poverty is not the same as exempting it to boost a football program.

Rather than distorting the tax code to chase athletic prestige, I propose a fairer alternative: a progressive income exemption available to all full-time students, tied to the cost of their tuition. If a student pays $12,000 in tuition, they could exempt that amount from tax—regardless of whether their income comes from NIL deals, a job in the library, or a work-study program. This model keeps relief targeted to those bearing educational costs while avoiding regressive giveaways to already well-compensated students. The tax code should reflect fairness and support for all students—not just the most marketable ones.

Student NIL Tax Breaks Would Put Splashy Recruits Above Fairness

Share this post